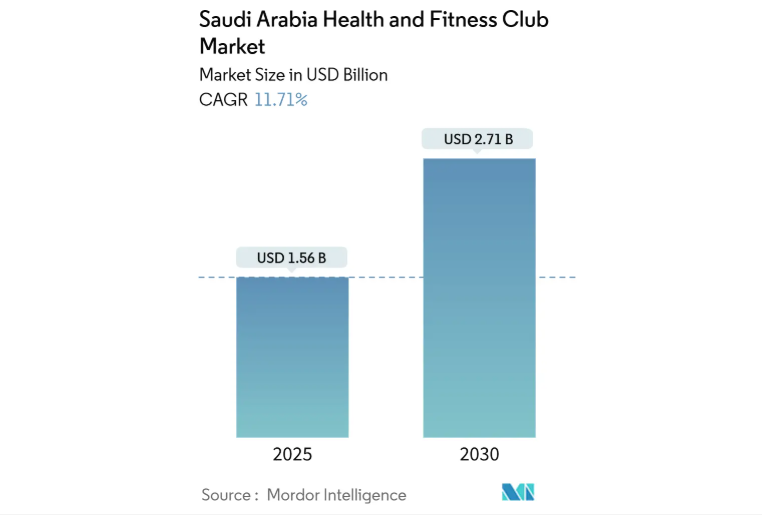

Saudi Fitness Market to Reach USD 2.71 Billion by 2030

The Saudi Fitness Market is on a steep growth trajectory, projected to expand from USD 1.56 billion in 2025 to USD 2.71 billion by 2030, reflecting a robust 11.71% CAGR. This surge is not just about gyms opening their doors—it’s about a cultural and economic shift. Rising disposable incomes, government-backed reforms, and a growing awareness of lifestyle-related health risks are reshaping how Saudis view fitness and wellness.

Membership Fees Dominate with 80.21% Market Share

In 2024, membership fees accounted for 80.21% of total revenues, underscoring the dominance of subscription-based models in the Saudi Fitness Market. This reliance on recurring memberships provides operators with predictable income streams, enabling reinvestment in facilities and services. However, the fastest-growing revenue stream is personal training and instruction, forecasted to grow at 13.12% CAGR through 2030. This reflects a consumer shift toward personalized, results-driven fitness experiences.

Men Lead Participation, but Women Drive Growth at 13.25% CAGR

Men currently represent 78.31% of participation in the Saudi Fitness Market, a legacy of cultural norms and facility access. Yet the real story lies in women’s accelerating involvement. Female participation is expected to grow at 13.25% CAGR through 2030, fueled by Vision 2030 reforms, women-only gyms, and shifting societal attitudes. This demographic shift is not only expanding the customer base but also redefining service offerings, from boutique studios to wellness-focused programs tailored for women.

Budget Gyms Hold 65.35%, While Premium Clubs Expand at 13.56% CAGR

Affordability remains a key driver, with budget gyms capturing 65.35% of revenues in 2024. These facilities appeal to price-sensitive consumers seeking essential services. Yet, the premium and boutique segment is the fastest-growing, advancing at 13.56% CAGR. Upscale gyms are attracting consumers willing to pay for advanced equipment, luxury amenities, and specialized classes. This dual-track growth highlights a market split between mass accessibility and aspirational wellness experiences.

Independent Operators Dominate with 67.31% Share, Chains Scale Faster

The Saudi Fitness Market remains fragmented, with independent operators holding 67.31% of the market in 2024. These local businesses thrive on community ties and service flexibility. However, chained facilities are scaling at 12.83% CAGR, leveraging brand recognition, standardized services, and operational efficiencies. This signals a gradual consolidation trend, where chains are poised to capture share from independents while professionalizing the sector.

Urbanization and Vision 2030 Fuel Market Expansion

Urbanization, with 85% of Saudis living in cities by 2024, is a critical driver of fitness adoption. Major cities like Riyadh, Jeddah, and Dammam are at the forefront, supported by government-backed infrastructure projects such as the SAR 2 billion Sports Boulevard. Vision 2030 reforms are equally transformative, embedding fitness into national development goals. By promoting healthier lifestyles and reducing obesity rates—currently 23.1% among adults—the government is ensuring that wellness is not just a trend but a national priority.

Challenges: Home Gyms, High Costs, and Talent Shortages

Despite strong growth, the Saudi Fitness Market faces hurdles. The rising popularity of home gyms and recreational activities is diverting some consumers away from clubs, reducing growth potential by an estimated -1.8% impact on CAGR. Premium gyms also face accessibility challenges due to high membership fees, while a shortage of certified Saudi trainers limits service quality, particularly outside major cities. Overcoming these barriers will require flexible pricing, investment in local talent, and hybrid digital-physical fitness models.

Regional Hotspots: Riyadh, Jeddah, and the Eastern Province

Riyadh leads the Saudi Fitness Market, driven by corporate wellness programs and large-scale infrastructure investments. Jeddah is emerging as a hub for women-focused fitness and tourism-linked wellness, while the Eastern Province benefits from corporate-backed initiatives, particularly from Aramco, which provides extensive employee wellness facilities. Together, these regions form the backbone of Saudi Arabia’s fitness transformation.

Outlook: A Market Balancing Scale and Personalization

The Saudi Fitness Market is evolving into a dynamic ecosystem where affordability, personalization, and inclusivity intersect. With international brands entering, local operators innovating, and government reforms accelerating adoption, the sector is set to redefine wellness in the Kingdom. By 2030, the market’s USD 2.71 billion size will reflect not just economic growth, but a societal shift toward healthier, more active lifestyles.

Also Read: Saudi Women’s Sports Now Broadcast Worldwide