$6.3 Billion Invested in Events Fuels Saudi Sports Economy Expansion

Since 2021, Saudi Arabia has invested over $6.3 billion in hosting and developing major sporting events, positioning itself as a global sports hub. The Kingdom’s successful bids for the 2027 AFC Asian Cup, the 2029 Asian Winter Games, and the highly anticipated 2034 FIFA World Cup reflect a strategic pivot toward sports as a national growth engine.

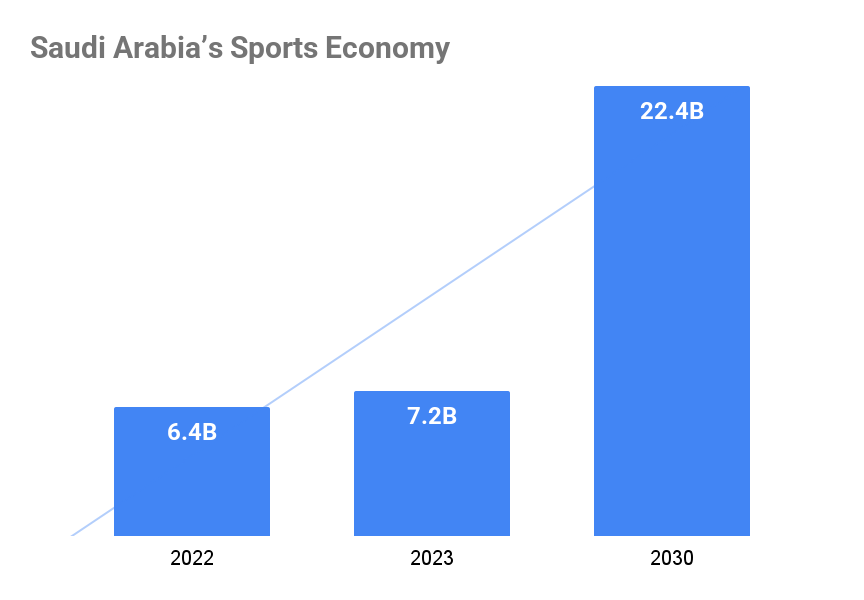

These investments are part of a broader transformation: the Saudi sports market grew from $6.4 billion in 2022 to $7.2 billion in 2023, and is projected to reach $22.4 billion by 2030. This tripling of market value is driven by infrastructure development, global partnerships, and rising youth engagement.

The Saudi Pro League, now broadcast in 160+ countries and featuring players from 50+ nations, exemplifies the Kingdom’s strategy to globalize its domestic sports product and attract international talent.

Sports Branding as a Tourism Engine

Saudi Arabia’s sports strategy is tightly interwoven with tourism and national branding. Between 2021 and 2024, the Kingdom has hosted 80 international sporting events, attracting 2.5 million tourists and generating significant economic impact—from SAR 900 million (US$239.85 million) in Jeddah during Formula 1 to record attendance at the Riyadh Marathon.

Major events like the Esports World Cup, which drew over 3 million visitors in 2024, have become soft power tools, showcasing Saudi Arabia’s hospitality, infrastructure, and cultural openness.

Looking ahead, the 2034 FIFA World Cup is projected to attract over 1.2 million spectators, supported by 15 new stadiums and a hospitality expansion targeting 230,000 hotel rooms.

This branding-through-sports approach is a cornerstone of the Saudi Sports Economy Expansion, turning stadiums into symbols of global engagement and positioning the Kingdom as a year-round destination for tourism, investment, and cultural exchange.

ATP, PFL, and SPL Deals Cement Global Partnerships

Strategic partnerships are accelerating the Saudi Sports Economy Expansion.

- ATP Tour – Men’s Tennis:

In February 2024, the Public Investment Fund (PIF) signed a multi-year strategic partnership with the ATP Tour. PIF became the official naming partner of the ATP Rankings and committed to supporting events in Indian Wells, Miami, Madrid, Beijing, and the Nitto ATP Finals. It also backs the Next Gen ATP Finals in Jeddah through 2027.

- Professional Fighters League (PFL) – MMA:

In August 2023, PIF—via its sports-focused subsidiary SRJ Sports Investments—invested over $100 million into the PFL. This deal includes launching PFL MENA, a regional MMA league, and hosting PFL Super Fight pay-per-view events in Saudi Arabia.

- Roshn Saudi League (SPL) – Football:

For the 2024/25 season, the Saudi Pro League—branded as the Roshn Saudi League—will generate an estimated $54.53 million in sponsorship revenue, making it one of the most commercially active football leagues in Asia. The title sponsorship by Roshn, a PIF-owned real estate firm, contributes $25.53 million annually.

Broadcast reach has expanded dramatically, with matches now aired in over 160 countries across 38 global platforms, including DAZN and ESPN Africa. These deals reflect Saudi Arabia’s strategy to globalize its domestic football product and embed the SPL within the broader Saudi Sports Economy Expansion.

These partnerships span football, tennis, and MMA, three of the most globally visible and commercially dynamic sports ecosystems, positioning Saudi Arabia at the heart of international fan engagement and media expansion.

Smart Stadiums & Inclusive Infrastructure in Saudi Arabia Sports Economy

Saudi Arabia’s sports infrastructure push is designed for long-term impact. Ahead of the 2034 FIFA World Cup, the Kingdom is building 15 stadiums: 11 new and 4 renovated, alongside 134 team and referee facility pairings, 72 base camp hotels, and 60 venue-specific accommodations.

Modern stadiums now integrate AI and IoT technologies to optimize energy use in real time. Systems like digital lighting and automated HVAC respond to crowd density, reducing carbon emissions. These innovations can deliver up to 40% energy savings, supporting Saudi Arabia’s sustainability goals.

Meanwhile, inclusive growth is reflected in the expansion of female football leagues and the rollout of 500+ women’s sports centers across Saudi Arabia, embedding sports into daily life and reshaping community engagement.

With 700,000+ girls now participating in school football leagues and female player numbers up 195% since 2021, these initiatives go beyond hosting events; they signal a structural shift in access, aspiration, and everyday participation.

$22.4 Billion Market Value Forecast by 2030

The Saudi Sports Economy Expansion is projected to triple the sector’s value from $8 billion in 2023 to $22.4 billion by 2030. Sports already contribute 1% of GDP, with expectations to reach 1.5%; equivalent to $16.5 billion by 2030.

With over two-thirds of the population under 35, demand for sports participation and viewership is surging. Emerging sectors like esports, padel, and women’s sports are unlocking new revenue streams.

Saudi Arabia is laying the foundation for a $22.4 billion sports economy. One built on infrastructure, investment, and long-term sectoral growth.

Also Read: Saudi Arabia Sports Industry: A US$8.5B Investment Magnet